Assignment Code - DD125865DE

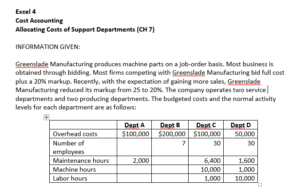

Excel 4

Cost Accounting

Allocating Costs of Support Departments (CH 7)

INFORMATION GIVEN:

Greenslade Manufacturing produces machine parts on a job‐order basis. Most business is obtained through bidding. Most firms competing with Greenslade Manufacturing bid full cost plus a 20% markup. Recently, with the expectation of gaining more sales, Greenslade Manufacturing reduced its markup from 25 to 20%. The company operates two service departments and two producing departments. The budgeted costs and the normal activity levels for each department are as follows:

Dept A | Dept B | Dept C | Dept D | |

Overhead costs | $100,000 | $200,000 | $100,000 | 50,000 |

Number of employees | 7 | 30 | 30 | |

Maintenance hours | 2,000 | 6,400 | 1,600 | |

Machine hours | 10,000 | 1,000 | ||

Labor hours | 1,000 | 10,000 |

- Costs of Department A are allocated on the basis of

- Costs of Department B are allocated on the basis of maintenance

- Departmental overhead rates are used to assign costs to products. Department C uses machine hours and Department D uses labor

- The firm is preparing to bid on a job (Job K) that requires three machine hours per unit produced in Department C and no time in Department Expected prime costs are $67.

Required:

- Allocate the service costs to the producing departments using the direct

- What will the bid be for Job K if the direct method of allocation is used?

- Allocate the service costs to the producing departments using the sequential

- What will the bid be for Job K if the sequential method of allocation is used?

- Allocate the service costs to producing departments using the reciprocal

- What will the bid be for Job K if the reciprocal method of allocation is used?

IMPORTANT INSTRUCTIONS:

This problem should be worked on Excel and submitted in an Excel workbook! Organize the Excel spreadsheets in the order of the questions you must show your work and the steps can be easily followed and the steps are clear. Use the part letters above to help organize your answer. You may want to do multiple spreadsheets or use the workbook function of Excel.

Assignment Code - DD125865DE

Excel 4

Cost Accounting

Allocating Costs of Support Departments (CH 7)

INFORMATION GIVEN:

Greenslade Manufacturing produces machine parts on a job‐order basis. Most business is obtained through bidding. Most firms competing with Greenslade Manufacturing bid full cost plus a 20% markup. Recently, with the expectation of gaining more sales, Greenslade Manufacturing reduced its markup from 25 to 20%. The company operates two service departments and two producing departments. The budgeted costs and the normal activity levels for each department are as follows:

Dept A | Dept B | Dept C | Dept D | |

Overhead costs | $100,000 | $200,000 | $100,000 | 50,000 |

Number of employees | 7 | 30 | 30 | |

Maintenance hours | 2,000 | 6,400 | 1,600 | |

Machine hours | 10,000 | 1,000 | ||

Labor hours | 1,000 | 10,000 |

- Costs of Department A are allocated on the basis of

- Costs of Department B are allocated on the basis of maintenance

- Departmental overhead rates are used to assign costs to products. Department C uses machine hours and Department D uses labor

- The firm is preparing to bid on a job (Job K) that requires three machine hours per unit produced in Department C and no time in Department Expected prime costs are $67.

Required:

- Allocate the service costs to the producing departments using the direct

- What will the bid be for Job K if the direct method of allocation is used?

- Allocate the service costs to the producing departments using the sequential

- What will the bid be for Job K if the sequential method of allocation is used?

- Allocate the service costs to producing departments using the reciprocal

- What will the bid be for Job K if the reciprocal method of allocation is used?

IMPORTANT INSTRUCTIONS:

This problem should be worked on Excel and submitted in an Excel workbook! Organize the Excel spreadsheets in the order of the questions you must show your work and the steps can be easily followed and the steps are clear. Use the part letters above to help organize your answer. You may want to do multiple spreadsheets or use the workbook function of Excel.